Written by Minyanville

These dead-wrong determinations seemed like reasonable choices to somebody at some point. But time has exposed them as mammoth mistakes.

Mistakes they’d like to take back

“Experience is the name everyone gives to their mistakes,” Oscar Wilde wrote. And so it can be said that business history has endured some tremendously embarrassing and shortsighted experiences.

At one point, a Texas tycoon looking to buy a software company decided that a young Bill Gates was asking too much for his startup, Microsoft (MSFT).

In London, an experienced music executive felt that four young men from Liverpool, England, weren’t worth his record label’s financial backing.

Ten years ago, the chiefs of two major media companies thought their fortunes would be richer if they merged their operations. They could not have orchestrated a bigger flop if they had tried.

Click through the gallery to read about these corporate missteps and other business decisions that proved to be stunningly ill-considered.

1. Buy Google for $750,000? No, thanks

Remember Excite? Formed in 1994 as Architext and relaunched as Excite the next year, it was meant to be the search engine to end all search engines. With funding from some of Silicon Valley’s top investors, the company went on to enjoy a highflying initial public offering after hiring a new CEO, George Bell, in 1996.

Back then, there was nothing that dot-com stock couldn’t buy, and Excite, a company worth $35 billion, went on an acquisition spree with its riches. In addition to many smaller deals, it paid $425 million for iMall and a whopping $780 million for online greeting-card company Blue Mountain Arts.

But when two young Stanford University students came knocking, looking for someone to buy their nascent search engine so they could return to their studies, Bell would have none of it. In 1999, Google (GOOG) founders Larry Page and Sergey Brin offered Excite their business for $1 million. Bell deemed it too high, and a second offer of $750,000 was also roundly rejected.

Google is a $180 billion company today.

And Excite?

In the fall of 2000, Bell resigned as the company’s CEO. By the time the third quarter of 2001 rolled around, Excite’s stock price had fallen to $1 a share.

2. Perot blows chance to own Microsoft

A 5-and-a-half-foot Texas business tycoon prone to folksy proverbs, Ross Perot, above left, is known for his quirky charisma. But long before he inspired comedic impersonators during his 1992 White House run, Perot made what he calls one of his biggest business mistakes ever.

The founder of Electronic Data Systems — now a division of Hewlett-Packard (HPQ) — Perot made a name for himself in the 1960s as a tech titan. By the next decade, he had his eyes on one company for a deal: Microsoft (MSFT). A deal would have provided Perot with the software he wanted for his clients — and given the 30-employee startup a huge entry into the corporate world. (Microsoft is the publisher of MSN Money.)

Perot invited a gawky kid named Bill Gates, above right, into his office to discuss a deal in 1979. Negotiations broke down, and the two men remember the story differently. Perot recalls Gates’ asking price as somewhere between $40 million and $60 million, which Perot found too high. When asked about the events, however, Gates says he put Microsoft on the block for $6 million to $15 million. In any case, neither party attempted to counter, and no agreement was reached.

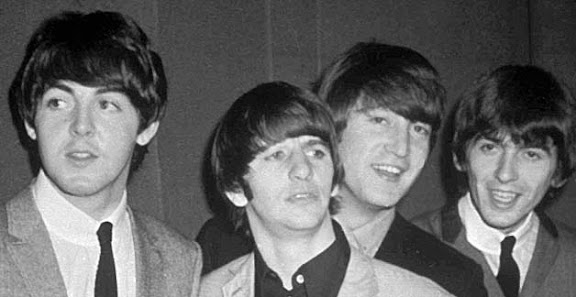

3. Decca rejects The Beatles

The Beatles have “no future in show business.”

Such was the verdict of a Decca Studios manager, who in 1962 rejected the young band after a studio audition in London.

Decca’s executives made the same mistake with other future music stars, including The Yardbirds and Manfred Mann, who went on to sign with other labels. But no single rejection in musical history compares with Decca’s colossal miscalculation on The Beatles.

Decca’s misstep became a terrific gain for rival label EMI, where producer George Martin knew to sign The Beatles as soon as he heard the hourlong tryout tapes. The rest is a rich and storied history.

In 1964, The Wall Street Journal estimated that The Beatles would sell $50 million in records in the U.S. alone. By 1971, by which time The Beatles had broken up, the former band mates had acquired a fortune of more than $22 million, a staggering sum then but only a tiny fraction of what they would ultimately be worth.

4. Apple lets Steve Jobs go

In 1983, Apple (AAPL) co-founder Steve Jobs needed a “grown-up” CEO to take the company to the next level. The man he picked for the job was PepsiCo (PEP) President John Sculley.

Jobs won over Sculley with a simple question: “Do you want to spend the rest of your life selling sugared water to children, or do you want a chance to change the world?”

Alas, Jobs found himself with a dark cloud devoid of a silver lining. He almost immediately began butting heads with Sculley, who took it upon himself to sabotage Jobs at every turn. He removed Jobs from the development of the Lisa computer and started a campaign to oust Jobs from the very company he started. In the meantime, Jobs launched a counterattack on Sculley, doing his damndest to get him fired.

The discord had a negative effect on Apple, and in 1984, after the somewhat unsuccessful launch of the Macintosh, the company posted its first-ever quarterly loss and let 20% of its staff go.

Later, Sculley gave Apple’s board an ultimatum: They could have him or Jobs, but not both. The board chose Sculley, and Jobs went on his way in 1985.

Eventually, Jobs returned to Apple, and the company returned to profitability. Today, Jobs has given the world the iPhone, the iPod, iTunes — the list could go on.

5. Time Warner merges with AOL

When MBA students study the lessons of the worst business decisions in corporate history, they often begin with one notorious case study: the AOL-Time Warner merger.

The deal, valued at $350 billion in 2000, was, and still is, the biggest corporate merger and the biggest failure. In December, the two companies finally managed to unwind the agreement.

There are myriad, much-discussed reasons the merger did not work. For one, the timing was off. The two companies came together just before the bursting of the tech bubble, when billions of dollars began evaporating from the markets. There was also the problem of size and the clashing of company cultures. Like many would-be happy marriages, AOL (AOL) and Time Warner (TWX) saw their relationship devolve into what one business columnist called “a turf war” infused with “cutthroat politics.”

To mark the 10th anniversary of the financial disaster, the architects of the original deal — including Steve Case, above left, AOL’s co-founder, and Gerald Levin, right, then Time Warner’s CEO — have surfaced to answer a big question: What were they thinking?

6. Dubai builds the world’s tallest building

In November, investors around the world watched as Dubai fell into a debt crisis that threatened to send markets tumbling. Struggling under $80 billion in debt, the city-state had to go hat in hand to its oil-rich cousins in Abu Dhabi and request a $10 billion bailout. Some say the rescue saved the global economy from a second economic dip.

So, what better time to unveil Dubai’s latest trophy: the tallest building in the world.

Unfortunately, many months before the crisis hit, the decision had been made to celebrate Dubai’s then-booming property market with “The Burj,” a 160-story building designed by Skidmore, Owings & Merrill architects. At 2,717 feet tall, the building is taller than New York’s Chrysler and Empire State buildings stacked together. Too narrow to house corporate offices on many of its upper floors, the tower was designed primarily for residential use.

Of course, the building opened just after the property bubble burst. In 2009, real-estate prices fell 50%. They’re expected to fall an additional 30% this year.

7. passes on ‘The Cosby Show’

After years working stages as a stand-up comedian, Bill Cosby’s sense of timing and delivery was inimitable, and it gave “The Cosby Show” a sophisticated sensibility. The TV show debuted in 1984 and, almost immediately, pulled in nearly 30 million viewers an episode. In the world of comedy television, it was a game changer, reviving the sitcom genre and giving NBC a huge boost.

It’s hard to believe that it almost never happened.

When Cosby, at center in the photo above, and his production company first proposed the show, they called on ABC executives to sell their concept. They were turned down.

Third-place network NBC gave Cosby a warmer reception. Having little to lose, the network signed the show, never expecting it would shoot up the ratings charts and hold the No. 1 spot in the Nielsen ratings for five straight seasons.

8. Drake neglects to patent oil drill

Tycoons and investors have made trillions of dollars from selling oil. Wars have been waged over its procurement and safekeeping. And nations have seen their histories changed and their standards of living skyrocket after a major find.

But the man who first learned how to get the black gold out of the ground died poor and nearly forgotten. So did the investor who first put up the cash to back his invention: the oil drill.

In 1858, Edwin Drake, a one-time train conductor, was hired by Seneca Oil — in truth, then just a group of investors — and asked to explore ways to extract oil from the Earth’s depths. The company sent Drake to Titusville, Pa., where the first reaction to his mission was typically one of extreme skepticism.

By 1859, Seneca Oil pulled the plug on the project. It had already financed the project with $2,000, and it refused to invest more without more promising evidence the drilling would eventually work.

Drake first approached salt drill operators, suggesting they could use similar technology to capture oil in the area. The nickname “Crazy Drake” was officially born.

But even after Drake’s method of hand-pumping oil from the ground finally proved workable, the inventor apparently did not recognize the potential value in patenting it. Other entrepreneurs quickly moved in and copied Drake’s method.

What do you think?

Let us know what you think. Add your comments below!

………………………………….

bonus:Brilliant Nikon camera ad! (nsfw)

Blockbuster not buying NetFlix

Argentinian football club River Plate not paying 20.000 dollars medical treatment for Messi when he was 13.The player is now worth 254 million euros (like 280-300 million dollars).

What about New Coke?

I like your comments and sites. Great info and best wishes to all of you!