Written by Kevin Purdy

Freelancing isn’t something you should just jump into, but it makes sense for a good number of workers. If you’re looking into, or getting started with, working on your own, here are 10 resources we think every freelancer can learn from.

Photo by Mat Honan, who is himself a freelancer.

10. Make your schedule family-friendly

If you’re going to have to entirely ignore your kids and family when you’re working at home, you might as well head into the office. Career columnist and Wall Street Journal writer Alexandra Levit offered up six tips for working parents to spend more time parenting. They were aimed at anyone with a job, but freelancers certainly have an easier time of shifting their schedules back and ahead, taking web meetings instead of traveling for in-person summits, and involving their children in their work. Photo by Amit Chattopadhyay.

If you’re going to have to entirely ignore your kids and family when you’re working at home, you might as well head into the office. Career columnist and Wall Street Journal writer Alexandra Levit offered up six tips for working parents to spend more time parenting. They were aimed at anyone with a job, but freelancers certainly have an easier time of shifting their schedules back and ahead, taking web meetings instead of traveling for in-person summits, and involving their children in their work. Photo by Amit Chattopadhyay.

9. Do it without quitting your day job

Why freelance on the side instead of full time? The taxes are a lot more simple, the income a bit more stable, and, best of all, your day-to-day job provides you with countless opportunities to meet and greet future clients and referral helpers. That’s assuming your side gig is kosher with your boss, of course, but if you want to test the waters of selling yourself on the freelance market, do it without quitting your job.

Why freelance on the side instead of full time? The taxes are a lot more simple, the income a bit more stable, and, best of all, your day-to-day job provides you with countless opportunities to meet and greet future clients and referral helpers. That’s assuming your side gig is kosher with your boss, of course, but if you want to test the waters of selling yourself on the freelance market, do it without quitting your job.

8. Use discounts to get paid on time

Becoming your own Accounts Payable department is new to most freelancers, and not very fun. If you run into clients who are hesitant to pay on time, or leave you on the hook waiting for their next order, try offering a discount or repeat business incentives, as suggested by Web Worker Daily. Give clients a 5 percent discount if they pay within, say, 24 or 48 hours of invoice shipment, or whatever you consider prompt—the cash value is almost certainly worth the time you’ll spend tracking it down and worrying. If clients make you wait forever for their next order, offer a coupon or discount after receiving payment on a gig, giving them a small bit off if they place another order within a certain time frame. It’s easy for small businesses to lose track of freelance people, but they tend to pay attention to dollars and cents. (Original post)

Becoming your own Accounts Payable department is new to most freelancers, and not very fun. If you run into clients who are hesitant to pay on time, or leave you on the hook waiting for their next order, try offering a discount or repeat business incentives, as suggested by Web Worker Daily. Give clients a 5 percent discount if they pay within, say, 24 or 48 hours of invoice shipment, or whatever you consider prompt—the cash value is almost certainly worth the time you’ll spend tracking it down and worrying. If clients make you wait forever for their next order, offer a coupon or discount after receiving payment on a gig, giving them a small bit off if they place another order within a certain time frame. It’s easy for small businesses to lose track of freelance people, but they tend to pay attention to dollars and cents. (Original post)

7. Track your work and generate invoices simultaneously

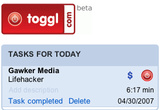

The web is full of freelancers and contractors, and many of them have created better systems for tracking time and sending bills. There are too many free or “freemium” services to try and compile into one list, but, hey, let’s throw out a few. MakeSomeTime is simple, CurdBee handles everything up to the Google Checkout/PayPal payment screen for clients, FreshBooks covers a lot of different aspects of billing, Toggl is a great second-by-second live tracker, and BlinkSale has been generating crisp-looking invoices for years. Any of them are worth checking out, and probably fit the bill better than a gigundo spreadsheet. (Original post)

The web is full of freelancers and contractors, and many of them have created better systems for tracking time and sending bills. There are too many free or “freemium” services to try and compile into one list, but, hey, let’s throw out a few. MakeSomeTime is simple, CurdBee handles everything up to the Google Checkout/PayPal payment screen for clients, FreshBooks covers a lot of different aspects of billing, Toggl is a great second-by-second live tracker, and BlinkSale has been generating crisp-looking invoices for years. Any of them are worth checking out, and probably fit the bill better than a gigundo spreadsheet. (Original post)

6. Know what you can write off

If you’re starting to get actual, notable income from your freelance work, the first thing you should do is find someone who know how to handle the taxes of independent contractors. Gina proved the value of a good accountant in her human versus TurboTax.com showdown, but noted that an experienced filer could probably make due with the tax software solution. The Freelance Switch blog also offers 10 easy-to-miss freelancer deductions, like coffeeshop meetings, unpaid invoices, and gig hunting expenses, that any independent worker would do well to look into. (Original post)

If you’re starting to get actual, notable income from your freelance work, the first thing you should do is find someone who know how to handle the taxes of independent contractors. Gina proved the value of a good accountant in her human versus TurboTax.com showdown, but noted that an experienced filer could probably make due with the tax software solution. The Freelance Switch blog also offers 10 easy-to-miss freelancer deductions, like coffeeshop meetings, unpaid invoices, and gig hunting expenses, that any independent worker would do well to look into. (Original post)

5. Find more work

Cold calling is not fun, and if you think it might be, watch Glengarry Glen Ross again. A good lead comes from knowing where people are looking. FreelanceSwitch has compiled a monster list of freelance job sites, though some of them are going to be hired-gun-type, low-paying grunt work. On the other hand, a 10-minute call to your clients can get you all kinds of results you weren’t even looking for. (Original post)

Cold calling is not fun, and if you think it might be, watch Glengarry Glen Ross again. A good lead comes from knowing where people are looking. FreelanceSwitch has compiled a monster list of freelance job sites, though some of them are going to be hired-gun-type, low-paying grunt work. On the other hand, a 10-minute call to your clients can get you all kinds of results you weren’t even looking for. (Original post)

4. Track your pitches with a custom spreadsheet

Who should you call with a reminder that you’re available, and who needs a quick follow-up on a pitch? Those are questions you should have answers for. Web Worker Daily’s Celine Rogue explains how to set up a spreadsheet with drop-down choosers, collated data, and other tools to become a great pitch, client, and job tracker. Half of life is just showing up, after all, and some extra percentage is knowing exactly where and when to be present with an offer. (Original post)

Who should you call with a reminder that you’re available, and who needs a quick follow-up on a pitch? Those are questions you should have answers for. Web Worker Daily’s Celine Rogue explains how to set up a spreadsheet with drop-down choosers, collated data, and other tools to become a great pitch, client, and job tracker. Half of life is just showing up, after all, and some extra percentage is knowing exactly where and when to be present with an offer. (Original post)

3. Get into the estimated tax groove

If you don’t cover the tax burden throughout the year of not having an employer to deduct social security, unemployment, and other taxes for you, the month of April will truly be the cruelest. Read how our own self-employed readers set aside money for estimated taxpayments four times each year (or in other installments), and read how Gina automates her finances to always have the money on hand, even when her income is very variable.

If you don’t cover the tax burden throughout the year of not having an employer to deduct social security, unemployment, and other taxes for you, the month of April will truly be the cruelest. Read how our own self-employed readers set aside money for estimated taxpayments four times each year (or in other installments), and read how Gina automates her finances to always have the money on hand, even when her income is very variable.

2. Learn your legalese

Besides having to learn the basics of contracts and work rules, freelancers should try to grab the basics of selling and regulating resalable (and different) stock work, as well as know how to stand their ground on copyright, fair use, and Creative Commons. It is, in short, not enough to simply create cool things—you have to know how to shepherd them through the cloudy worlds of commerce and the web these days. Photo by MikeBlogs. (Original posts: legal resources, stock work).

Besides having to learn the basics of contracts and work rules, freelancers should try to grab the basics of selling and regulating resalable (and different) stock work, as well as know how to stand their ground on copyright, fair use, and Creative Commons. It is, in short, not enough to simply create cool things—you have to know how to shepherd them through the cloudy worlds of commerce and the web these days. Photo by MikeBlogs. (Original posts: legal resources, stock work).

1. Determine your hourly rate

Not every contract will rely on hourly rates, but you’d best be prepared to offer a price if someone asks. The general advice is to aim slightly higher than you figure you should really charge, because you will always, always aim low when you’re determining the time and administrative costs of getting the job done. If you want a more concrete number to base your rate on, try FreelanceSwitch’s hourly rate calculator, which takes your office and supply costs, experience, and other factors into account. (Original post)

Not every contract will rely on hourly rates, but you’d best be prepared to offer a price if someone asks. The general advice is to aim slightly higher than you figure you should really charge, because you will always, always aim low when you’re determining the time and administrative costs of getting the job done. If you want a more concrete number to base your rate on, try FreelanceSwitch’s hourly rate calculator, which takes your office and supply costs, experience, and other factors into account. (Original post)

If you’re an established freelancer, what apps, tools, or advice did you find truly helpful when starting out? If you’re still green at working for yourself, what do you need the most help with? Swap the tips and stories in the comments.