Written by Joshua Ritchie

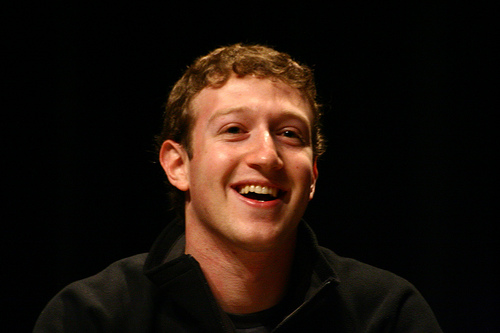

Tech geeks and Facebook enthusiasts are filling America’s theaters to see The Social Network, a film about Mark Zuckerberg and the founding of the now ubiquitous social networking site. We won’t spoil the plot for you, except to say that it does not paint Zuckerberg in an especially flattering light. Facebook’s founder (though wildly successful) is portrayed as being selfish, stuck-up and disloyal to his closest friends. (Not surprisingly, Facebook far from endorses the movie: Zuckerberg, according to the New York Times, has called the movie “fiction.”)

But while the movie is hardly a sterling example of etiquette, it does offer some outstanding big-picture lessons about personal finance and money management.

Be Decisive

For all Zuckerberg’s unsavory traits (and the movie portrays plenty) there is no denying his decisiveness. When the idea of allowing Facebook users to list their relationship status on their pages sprang to mind, he didn’t scribble it down in a notebook and tell himself he’d do it later: he ran to his dorm across a snowy field in flip-flops to code it right away. When he decided to expand Facebook, he immediately dispatched marching orders to his team about infiltrating other Ivy League schools.

When it comes to our financial affairs, many of us are not nearly as decisive. We’ll skim through articles about investing or retirement planning, but how many of us would immediately invest into an index fund or set up an IRA? If you already have, great! If not, resolve to be more decisive about your money. As soon as it becomes clear that you ought to be doing something, get down to doing it.

Take The Long-Term View

For all his good intentions, Eduardo Saverin (Mark’s then business partner and best friend) failed to see the big picture of what Facebook was becoming. Like any good businessperson, he looked at Facebook’s exploding user-base and saw something to be monetized. Thus, he constantly pressured Zuckerberg to start hooking up with advertisers and capitalizing on the popularity of the website. But Zuckerberg staunchly resisted. After all, he said: thousands of people were falling all over themselves to join Facebook every day, just the way it was. Cluttering up the site with ads could have destroyed Facebook’s growth for a relatively pitiful amount of money.

A similar lesson applies to you and your financial life. Like most people, you probably have long-term goals: maybe it’s home ownership, a new car, or the dream of some day starting a business. The only way to reach these goals is by making sacrifices in the short-term. Sure, you could theoretically spend your latest raise on a $5,000 wardrobe, but how long will that delay your dream of owning a home?

Keep Costs Low

One aspect of The Social Network that isn’t getting much attention is how little money Facebook spent early on. Facebook (today worth over $25 billion) required just $19,000 in startup capital before getting VC funding. $19,000 is no small sum in most situations, but in light of what Facebook ultimately became, it’s barely a drop in the bucket.

The way Facebook stretched that money so far is by using it only for what mattered most: servers, good ones and lots of them. This concept is one we can all follow. In his New York Times best-seller I Will Teach You To Be Rich, Ramit Sethi tells readers to “spend extravagantly on the things you love, and cut costs mercilessly on the things you don’t.” If you can live with bargain brand toilet paper or peanut butter or taco shells, for instance, there will be more money to spend on the entertainment, clothes or hobby that you truly love.

Do Your Homework

In The Social Network, Mark Zuckerberg is often seen bragging about how smart he is. If Harvard’s network security team really knew what they were doing, it wouldn’t have taken them four hours to shut Facemash (Zuckerberg’s first website) down. If the Winklevoss brothers were truly Mark’s intellectual peers, they would’ve built Facebook instead of just thinking of something similar. It’s easy to dismiss all of this as arrogance, but that arrogance was well backed by intelligence.

In personal finance as in business, it really does pay to be knowledgeable. Your financial life is important. While money isn’t everything, the decisions you make about mortgages, savings and investments play a major role in shaping what kind of lifestyle you have. Luckily, you don’t need to be a Harvard-educated genius to make smart financial decisions. Just do your homework. Educate yourself on key financial topics by reading books and articles. Be open to constructive criticism and continuously examine whether you’re on the right track.